Table of Content

Wrought iron is known for being a little heavier and denser than most other metals. But it’s also a choice that adds a sense of elegance and refinement to any property you add it on to. Wrought iron features an intense black color in most cases although you could add paint to it if you want. Moreover, fence gates are an important functional aspect of the fence, offering entry and exit to space the fence surrounds.

A farm-style fence uses a series of wide wood materials. These are supported by tall beams of wood on the sites. The individual bars of metal are woven together to create a strong open pattern. Or you could go the traditional way and opt for the white picket fence.

Horizontal Ipe Fence

The slatted ones that slide not only look great but are also secure and private. It adds taste to security and can add character to any home. These add a charming rustic feel to your home without even trying much. It’s an added bonus if you have a garden because the green of your garden will go splendidly with this one. Add quirkiness to any dull old fence by fixing cut outs and shapes on them. With enough imagination, you might turn a boring old fence into something right out of Alice’s Wonderland.

Fewer timbers are used because no stringers are necessary. Although the weather-sensitive board ends of vertical fences face vertically, the board ends of horizontal fences head to the side. Gates constructed of metal are perfect for ensuring solid security and can be utilized for residential, commercial, or public applications. Instead of going for an old-school pattern, experiment with different designs and keep it aligned with the rest of the home. Each functions as a brace to keep the panel from drooping over time. The outer frame on each side also overlaps in opposite ways at each corner to make the gate even more solid.

Full Property Details for 817 Gates Ave #2

This is, in fact, one of the main reasons why this type of metal is very much ideal for fence gates. Individual metal bars are twisted together to form a robust open design. A wooden fence gate will provide a location with a sense of security. This is due to the fact that wood is often thicker than many other materials.

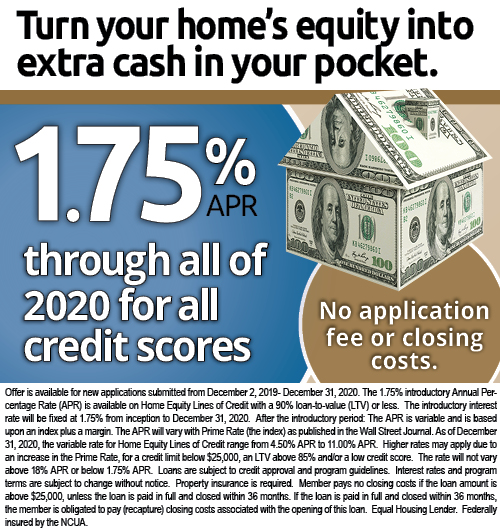

Sliding fence gates offer a convenient, secure, safe, and easily identifiable entrance. An electric fence gate is often constructed of thin aluminum or any type of steel. Agricultural electric fence gates offer just enough power to make the person touching it frightened. Wrought iron is slightly harder and heavier than most types of metal. It is, nevertheless, an effective fence gate option that gives a touch of elegance and precision to any property fence gate to which it is added. Wrought iron is often a deep black color, though it can be painted if desired.

DIY Living Privacy Gate On Wheels

The key is you want your fence gate to mimic the style of your fence. If you it’s a garden fence, you want a gate to offer a continued style so it doesn’t stick out like a sore thumb. Same thing whether a wood, vinyl, iron, chain link, lattice, picketor bamboo fence. Obvious the color should match as well unless you’re seeking to create an accent to your fence with a different colored gate. Farm fencing can come in many different styles and variations. Common farm fences include Split rail fencing, post and rail fence, post and barb wire fence, or any combination of fencing and wire material.

In this section, we will cover many common fence designs and types of fences for your backyard fence, front yard fence, or the entire perimeter of your property. These fence options include privacy fence design ideas for the backyard, front yard, and patio. Track sliding gate design is famous in commercial, residential, and office buildings due to its ease of use and smooth operation. Track sliding gates must be well maintained and made of durable material. To avoid friction and create a gurgling sound, grease the rails, channels, and rollers. The track sliding gates will last a long time if they are maintained well.

Re-purposed Shutter Fence

As the gate closes, the arm collides with the strike, which goes up and down by itself onto the catching attachment. This design is a gravity latch based on how it operates. This model operates by pressing the thumb depressor positioned on the ornamental plate on the exterior of the door. Pushing down causes the lock arm on the inside to raise, allowing you to open the fence gate. Numerous individuals envision a bolt latch as a method of securing their fence. The typical lock design works via securing the door by sliding the rod into the closing bolt.

This fence gate material will not deteriorate as a result of heavy rain. Vinyl has become a useful solution for fence gates for years now since it replaces wood with a synthetic version that is resistant to a variety of difficulties. It will not absorb a lot of water and will not scratch easily. Making sure your home and yard are safe is incredibly important. Here are a few ways to create great gate designs in different parts of your home.

Have you ever noticed when you’re driving by a farm that there’s a nice fence design that uses a series of thick horizontal wood posts? You can get such a style ready for use in your fence gate. Bamboo has become a beloved wood material for fence gates in recent years. This is thanks primarily to how bamboo is a fast-growing wood that is environmentally friendly. But what’s more is that bamboo has a dense body that won’t wear out quickly. Avoid keeping one of these fence gates near spots that kids or pets might regularly be found in.

Common where there are vast amounts of timber to use, split rail fencing can be placed together without the use of any tools or nails. A traditional bamboo fence design looks stunning with flowers and greenery enhancing this beautiful walkway. Adding lattice to the sidewall of an archway or gate design can easily complete your desired look and give room for ivy or flowers to grow. White lattice fence panels with pink flowers grow through to create a beautiful and dreamy wall. Small wood planks fixed horizontally and painted dark are a great example of designer fences.