Table of Content

LendingTree is compensated by companies on this site and this compensation may impact how and where offers appears on this site . LendingTree does not include all lenders, savings products, or loan options available in the marketplace. LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site . If you’re age 62 or older, you may be able to leverage your home equity in the form of a reverse mortgage. Rather than paying back the loan in monthly installments, you receive either a lump-sum, monthly payments or line of credit.

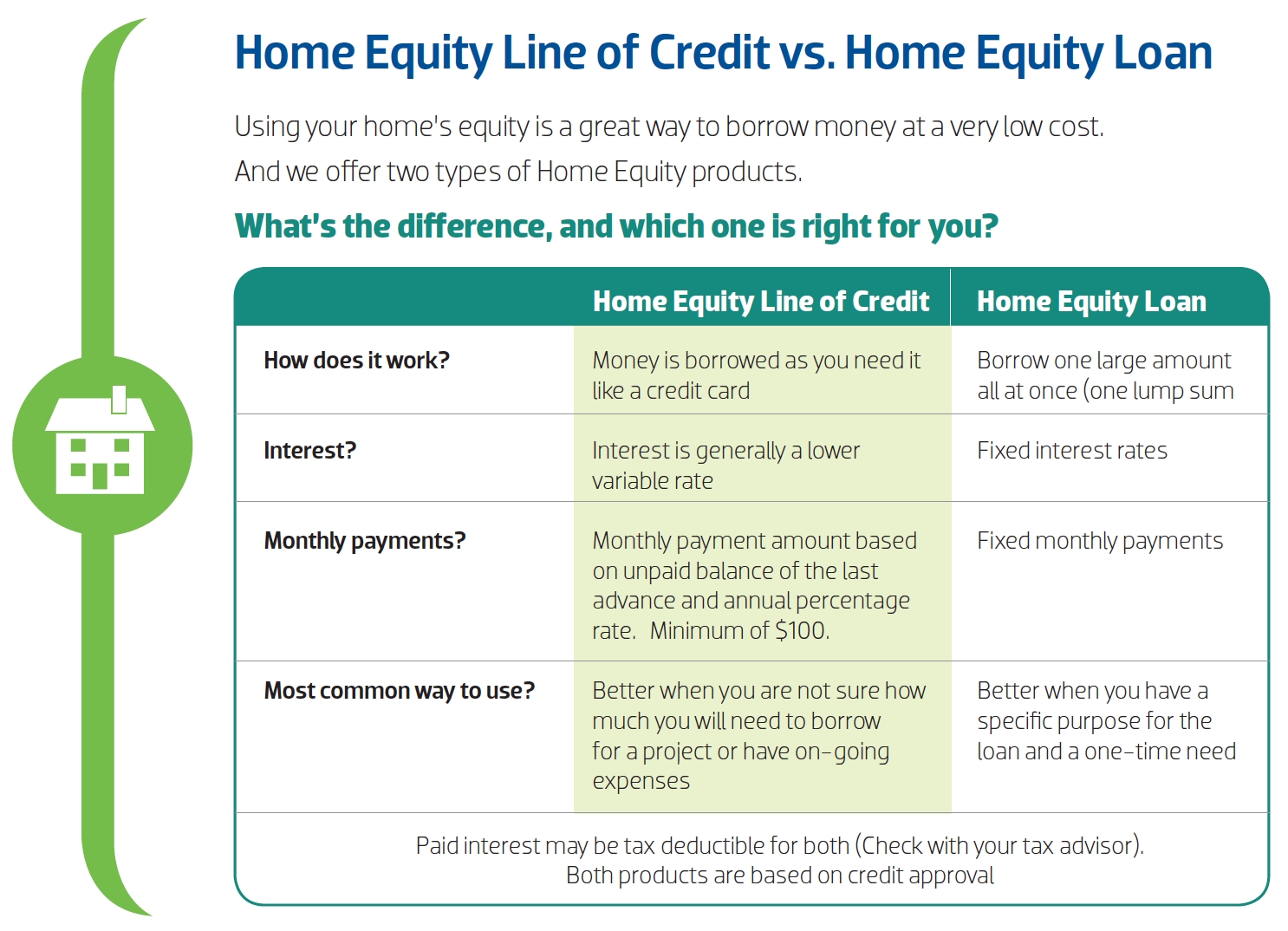

Another common type of home equity financing is a home equity line of credit . HELOCs are not traditional loans where you get paid a lump sum upfront. Instead, they work like a revolving line of credit, similar to a credit card secured by your home. The interest you pay on a home equity loan is tax deductible if you use the money on home renovations that improve the value of your residence. You can deduct the interest on up to $750,000 of home loans if you’re married and filing jointly or a single taxpayer.

What to Use A Home Equity Loan For

A personal loan lets you borrow a fixed sum of money at a fixed interest rate, to be repaid over a fixed period of time. Your interest rate will also affect your monthly payment and the total cost of the loan. Given the same loan amount and loan term, a higher interest rate will result in a higher monthly payment and more money paid in interest over the life of the loan. That’s why it’s important to shop around with multiple lenders to find the lowest interest rate. NextAdvisor’s loan calculator to calculate the total cost of borrowing and monthly payment to accurately compare lenders. In addition, Discover offers limited customer service options — your only option to get help is by phone, with no in-person service or online options like email or live chat.

You can cancel your loan for any reason, but the three-day cancellation rule only applies to home equity loans and HELOCs secured by your primary residence — not a vacation home or rental property. Home equity is the difference between what you owe on your mortgage and what your home is currently worth. In other words, it is your stake in the property, or what you could make if you sold before paying down the mortgage in full. Experts don’t recommend using a home equity loan for discretionary expenses like a vacation or wedding. Instead, try saving up money in advance for these expenses so you can pay for them in cash without taking on unnecessary debt.

How We Chose These Lenders

Repayment terms on home equity loans can be up to 15 years, while the typical personal loan term is two to seven years. Some personal loan lenders offer longer repayment terms of 12 or 15 years on home improvement loans. As with a home equity loan, you are borrowing against the available equity in your home, which is used as collateral. You can borrow as much as you need as often as you like throughout the draw period — usually 10 years. You can replenish your available funds by making payments during the draw period. At the end of the draw period, you will begin the repayment period, which is typically 20 years.

The lender decides how much you can borrow based on the amount of equity you have in your home. Most lenders won’t lend you the full amount of your equity, as this increases their risk. Bank of America’s mortgage preapproval time takes 10 days, which is a lengthy amount of time compared to other lenders. A long preapproval time is a disadvantage in a competitive seller’s market, where buyers are bidding against several other people and need to be ready with financing in order to make an offer. A cash-out refinance replaces your old mortgage with a new one for a larger amount than the current balance. The difference between the old mortgage and the new one is paid out to you in cash.

Incentive Stock Options or ISOs: Everything to Consider

Figure doesn’t charge maintenance fees, account opening fees or prepayment penalties. It does, however, charge a one-time origination fee of up to 4.99% of the initial draw. This fee can vary depending on your property location and credit experience.

Here are the average rates for home equity loans and HELOCs, as of Dec. 21, 2022. Homeowners ages 62 years or older may be able to convert their home equity to cash, monthly income or a line of credit through a reverse mortgage. Rather than having to make a payment on the amount borrowed, the interest is added to the loan each month. Some home equity lenders allow you to borrow on a second home or investment property, but at much lower LTV limits than a primary residence. You’ll get the best rates and highest LTV ratios if the home equity loan is secured by a home you’re living in.

Of course, the hope is that you would never end up in this situation. But if you do, it can damage your relationship along with both of your credit scores. Typically, lenders require that you have a LTV of 80% or less in order to borrow a home equity loan. To find out how much your home is currently worth, you’ll need to have it appraised, which typically costs a few hundred dollars. The period when you can spend money through your HELOC is called the draw period.

Meantime, while you're living there, that gain is locked up, out of reach — unless you access the equity with a home equity loan or a home equity line of credit, known as a HELOC. Home equity calculator can give you an idea of what your home is worth and how much equity you may have if you’re thinking about selling your home or borrowing a chunk of your equity. He has reported on mortgages since 2001, winning multiple awards.

Payments made outside of the 15-day grace period will be charged a late fee. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Once you’ve input this information, the calculator provides the estimated home equity loan amount you might qualify for. A home equity loan is a type of second mortgage that allows you to borrow against the equity you’ve built in your home. It’s an installment loan that’s repaid on a monthly basis, similar to a regular mortgage.

Founded in 2016, Spring EQ offers home equity loans with quick funding and high loan maximums. The lender is headquartered in Philadelphia and operates in 41 states and Washington, D.C. Our home equity loan calculator can help you determine how much available equity you might qualify to borrow with a home equity loan or home equity line of credit. Some lenders offer lower interest rates but charge higher fees . What matters most is your annual percentage rate because it reflects both interest rate and fees.

No comments:

Post a Comment